Driving Innovation in Prime Brokerage: 26 Degrees & Iress

At 26 Degrees Global Markets, innovation sits at the heart of everything we do. As a boutique prime broker, our mission is to deliver tailored solutions for hedge funds and broker dealers worldwide. A cornerstone of this mission is our long-standing partnership with Iress, a global leader in trading technology.

Recently, I sat down with Iress, one of our core technology providers, to discuss how the prime brokerage industry is evolving, and the critical role technology plays in meeting the needs of today’s clients. From shifting market dynamics to AI-driven innovation, I share my perspective on where the industry is heading and how 26 Degrees is positioning itself for the future.

Topics Covered:

Vision for the future

At 26 Degrees, our vision is to continue our evolution as a leading non-bank Prime Broker with global reach across Hedge Fund and Broker Dealer clients. Our aim is to build a highly integrated, multi-asset solution that spans both listed and OTC products. Alongside partners like Iress, we’re focused on providing reliable, sustainable, and high-quality access to markets, without compromising on our flexibility and ability to deliver innovative solutions.

Looking forward, we’re particularly excited about our growth in regions like the Middle East, South Korea, and Japan. These regions are rapidly expanding and looking for increasingly sophisticated, and frankly world-class, access to markets like the US, Europe, and Australia. At the same time, we’re seeing clients in established markets actively seeking diversification, and looking to us to unlock access to alternative and emerging markets with the same execution quality they expect from more traditional venues.

Navigating shifting market dynamics

We continue to have a close eye on how the trading landscape is evolving, and how this might shape client requirements in the future. One trend we’re closely engaged with is the ongoing extension of trading hours across major markets, particularly with the US moving towards 23-hour trading. At the same time, settlement cycles are shrinking across both equities and OTC markets, tightening the reporting window and pushing platforms and teams to adapt quickly.

These changes present unique challenges around staffing, reporting, and platform maintenance. We look forward to leveraging our global footprint and deep technological foundation, built on our strong relationships with partners like Iress, to tackle these challenges head on.

Another area we’re watching closely is capital flow. Over the past few decades, we’ve seen a staggering flight of capital into the US, which now accounts for 73% of the MSCI World Index [1]. We’re already seeing Hedge Funds and sophisticated investors turning to us for access to alternative markets and less conventional or underexposed opportunities. We’re keenly monitoring how our clients allocate capital across regions in today’s context.

Bespoke solutions for a global client base

As I mentioned earlier, we’re particularly excited about our growth into new markets like the Middle East, South Korea and Japan.

As we expand our global presence, client requirements become increasingly bespoke. We’re seeing an increasing focus on our risk functions, and being able to develop bespoke risk management solutions that work for client’s strategies, while still providing robust protection and clear visibility to all parties.

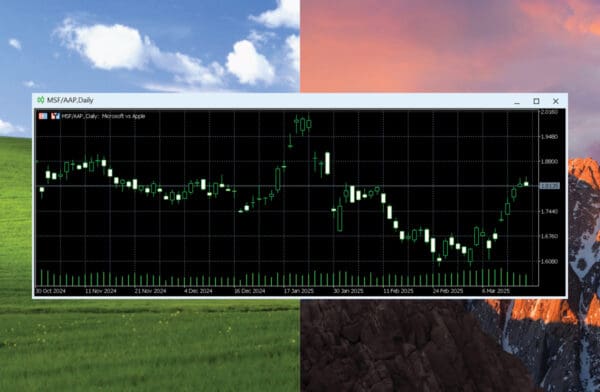

We’re also seeing clients come to us looking for structured products that meet client requirements, such as products that can enhance volatility. We’ve recently had a lot of success launching our Pairs CFD product to the market, where we’re able to match up any instrument against another, just like an FX Pair. Be that a stock versus a stock, a stock versus commodity, an index vs Gold etc.

Innovations like this highlight our ability to anticipate client needs and deliver unique solutions that set us apart in the market.

Driving innovation through AI:

We operate across multiple asset classes: foreign exchange, spot indices and commodities, equities, future, and more. To support this, we, have a large team of quants running analysis across all of our trade flows, to help us best price, in particular, OTC products, per client needs.

That’s somewhere we’re increasingly looking to incorporate AI, in terms of assisting our teams crunch through more data in a shorter period of time, accessing deeper levels of analysis and unlock value for our clients.

The role of Iress in supporting growth

Looking ahead, one of our key drivers of success will be continuing to build out our multi-asset vision. Iress is a key part of that journey as we build an increasingly cross-integrated platform and continue to add to our existing product suite that already covers equities, futures, FX, and spot indices and commodities.

We’re particularly excited by the growth of the Iress FIX Hub, as a gateway enabling seamless access to multiple asset classes across a variety of Hedge Fund execution platforms and proprietary Broker Dealer front ends.

We want to meet clients where they are, and a tool like the Iress FIX Hub and the ongoing growth of that is absolutely critical to the flexibility we need in our business going forward.

If you are interested in finding out more about 26 Degrees’ full-service prime brokerage solutions, and the Iress trading platform, reach out to our team here:

Start a conversation

Insights

Latest insights from

26 Degrees

Insights

Latest insights from

26 Degrees