Hedge Fund

Asset classes

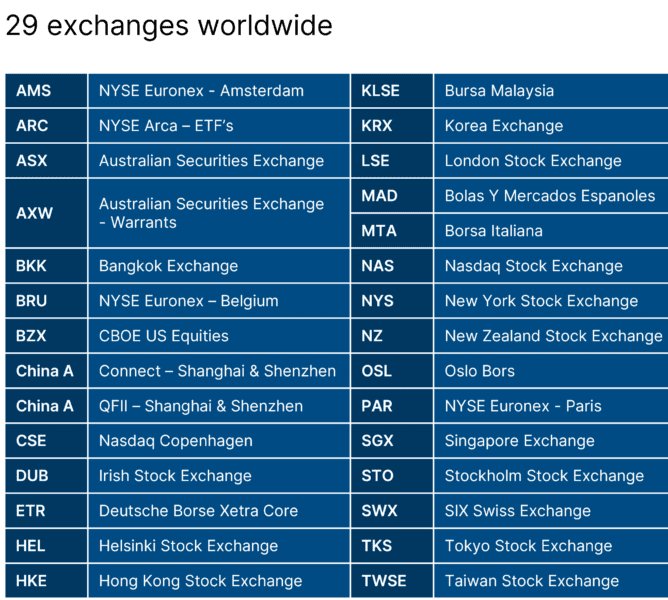

Equity and ETF Synthetics

Our clients have direct market access (DMA) to 29 stock exchanges globally allowing long and short trades directly to the underlying exchanges through Synthetic exposure.

Explore our Hedge Fund solutions

Equity Algorithm suite

26 Degrees offers a comprehensive suite of twelve

Algorithms including:

TWAP – Executes your order evenly split across pre-determined time intervals.

VWAP – Tracks historical intra-day volume data to execute your order.

SORTDMA – (Iceberg capability)

Provides access to exchanges and alternative liquidity sources (can also manage Iceberg orders using the “Display Qty” parameter).

TARGETPOV – (TPOV, Volume In Line)

Trades at a specific percentage of traded market volume and dynamically adjusts to real-time changes in volume.

Close – Aims to reduce slippage from the closing price by trading near the closing auction whilst minimising market impact.

Dynamic – Moves between a higher and lower participation rate based on the stock’s price relative to benchmark.

NextAuction – Provides the ability to enter a market or limit order for a future auction.

NightOwl – Seeks liquidity in both lit and dark venues.

NightVision – Accesses dark only liquidity.

Pegged – Seeks to adjust limit price to the bid, mid or offer.

TargetClose – Attempts to minimize impact relative to the current day’s closing price.

SORTDMAPP – Provides SORTDMA routing during the pre and post markets.

Algo execution

For Algo execution, we offer DMA through your choice of EMS, high touch execution via our outsourced trading team, or FIX API connectivity where you can use your Algo’s or ours.

Explore our Hedge Fund solutions

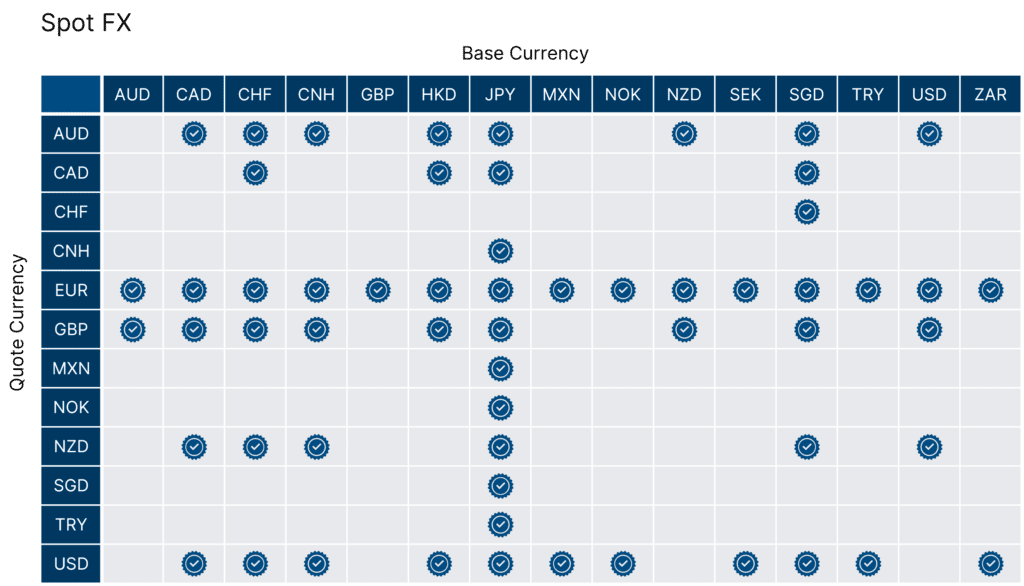

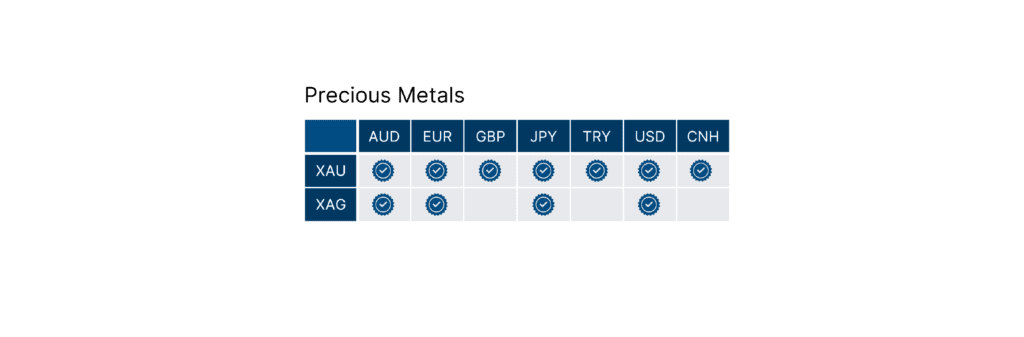

FX and Precious Metals

Our FX and Precious Metals offering ensures our clients have access to world-class liquidity from more than twenty bank, non-bank and ECN liquidity sources via our oneZero platform.

This allows for low-latency connectivity to OTC venues via high-capability API solutions.

Explore our Hedge Fund solutions

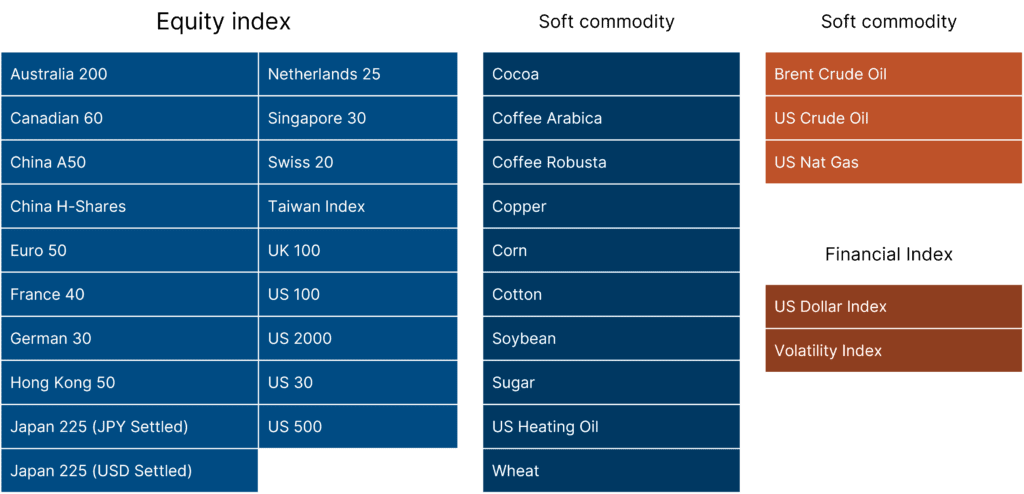

Index and Commodity

Our proprietary Index and Commodity Synthetic products are structured by our in-house quantitative structuring and

pricing team.

The product allows access to a broad range of spot indexes as listed below with a fully transparent pricing structure.

26 Degrees streams live prices in all markets via oneZero or to your chosen execution venue/API solution.

Explore our Hedge Fund solutions

Tier 1 Prime Broker relationships supporting three and four way give-ups

Industry leading, but don’t just

take our word for it...

We are active in ASX small cap stocks, so we value the excellent attention by 26 Degrees to this end of the stock market."

Insights

Latest insights from

26 Degrees