From liquidity to technology: How FXPB is evolving

To view the full article by e-Forex, please click here

The prime brokerage world has seen some significant volatility over the past year. Regulatory changes (like the EU’s impending Digital Operational Resilience Act,) the rise of multi-asset trading solutions, technological innovations, and rising exchange fees have led prime brokerage providers to rethink their business models. Despite all this, the sector’s outlook remains bullish. A recent report by Acuiti, in partnership with Standard Chartered Bank, detailed the rising demand from proprietary trading. Not everything is rosy, though. A separate Acuiti report noted concerns amongst smaller hedge funds regarding the consolidation in the prime brokerage world and its impact on execution risk. Prime brokerage service providers are facing tough questions from their clients and the industry, at large.

Sector changes and growth avenues

While regulatory changes have occupied prime brokerage service providers’ minds, the FX Global Code has had a bigger impact on operations, according to 26 Degrees Global Markets’ Chief Commercial Officer, James Alexander.

“The heightened scrutiny brought about by the FXGCC has encouraged liquidity providers to both generate and cancel far more quotes than was previously the case,” he says. “This practice has the effect of lowering the need for longer ‘last look’ windows and lowers rejection rates.”

While all of this is desirable, it has had infrastructure impacts. “It significantly increases the quote load on infrastructure and networks involved in the processing and transmission of quotes to clients,” he explains.

“Liquidity providers would rather generate a quote and cancel/replace it quickly than be seen to be rejecting an order. This trend is expected to continue as major exchange and aggregation venues lower their quote throttles and increase refresh rates.”

Coupled with these changes, Alexander says FX demand in APAC markets is strong. “ It is clear that several Investment banks continue to target this region as a key part of their growth strategy for FXPB. This is not the case for other asset classes such as Equity and Equity derivatives.”

Has the move to T+1 settlement had any effect on this demand, though? Alexander believes Asia will benefit from it. “Asian-based teams are well placed from a time-zone perspective to assist with the EOD settlement processing workflows that T+1 will require.”

“The move to T+1 settlement for certain spot instruments should ultimately drive down settlement risk and margin requirements for FX PB,” he continues, “driving growth opportunities once all parties ‘bed in’ the required infrastructure and operational changes needed for this change.”

Client expectations and catering to their needs

Many traditional bank FXPB service providers remain under pressure and unable to cater to client needs. James Alexander expands on this theme. “As a non-bank PB ourselves,” he says, “a key advantage of 26 Degrees is our multi-asset solution which is delivered via a single facility.”

“Delivery of exchange and OTC pricing, execution, and clearing are combined with liquidity optimisation and TCA. The integrated nature of the offering is not generally available from investment bank PBs.”

Alexander zooms out and offers insight into why bank PBs are not offering these products and services, “Global investment banks continue to feel the pressure of regulatory changes in FXPB, largely due to increasing capital requirements.”

He says much of this is driven by the regulatory pressures brought about by Basel II and Basel III. Many buy-side firms as a result are now actively considering or pursuing a strategy of PB diversification.

“Many clients or former clients have become increasingly disenfranchised by the diminishing service levels and more costly access to liquidity and clearing services they face.”

This disenfranchisement combined with technological advances has resulted in clients unwilling to tether themselves to a single PB. Instead, Alexander says, they’re looking for FXPB facilities that can interoperate seamlessly between primary and backup providers.

“Efficient give-up workflows, pre-trade margining with more accommodative terms, and integrated liquidity construction, optimisation, and reporting are all now considered ‘must haves’ in the multi-PB environment,” he explains.

“Specifically on liquidity, ever more sophisticated quote filtration and curation are being demanded from trading systems. Consumers of liquidity, especially those who execute electronically using algo executions or AI models rely on a well-curated price to ensure that various trading models and execution systems are running as optimally as possible,” he says.

Sector events like the exit of Credit Suisse as an LP in FX and precious metals have disrupted liquidity in spot markets. “Quote filtration logic needs to have the flexibility to address this heightened volatility,” Alexander says, “even during low liquidity periods where a smaller cohort of liquidity providers may be actively pricing.”

PB consolidation risks and choosing a broker

While non-traditional PBs continue to rise, market participants remain focused on the elephant in the room. Namely, the consolidation of the FXPB sector and the risks emerging from it.

Alexander says, “The consolidation in the FXPB sector is material and is going to continue in our opinion,” he says. “Access to credit is becoming harder, margin requirements are increasing and NOP limits are generally becoming more conservative.”

He notes that many buy-side firms and broker-dealers are feeling constrained. Most of them are unfamiliar with the role that a non-bank PB can play as part of the solution.

“Integrated liquidity management and more accommodative margin terms (applied on a pre-trade basis for prudent risk management), are two material benefits,” he says. “As is the margin benefit that can come from multi-asset diversification within a single portfolio.”

He adds that the biggest commercial impact will be increased facility minimums, not necessarily higher clearing fees. Non-bank FXPBs offer a significant advantage here since facility minimums are far lower with these providers.

“Many non-bank PBs support three and four-way give-ups to various Tier 1 prime broker venues ensuring there is no loss of netting or collateral efficiency when dealing with more than one counterparty,” he explains.

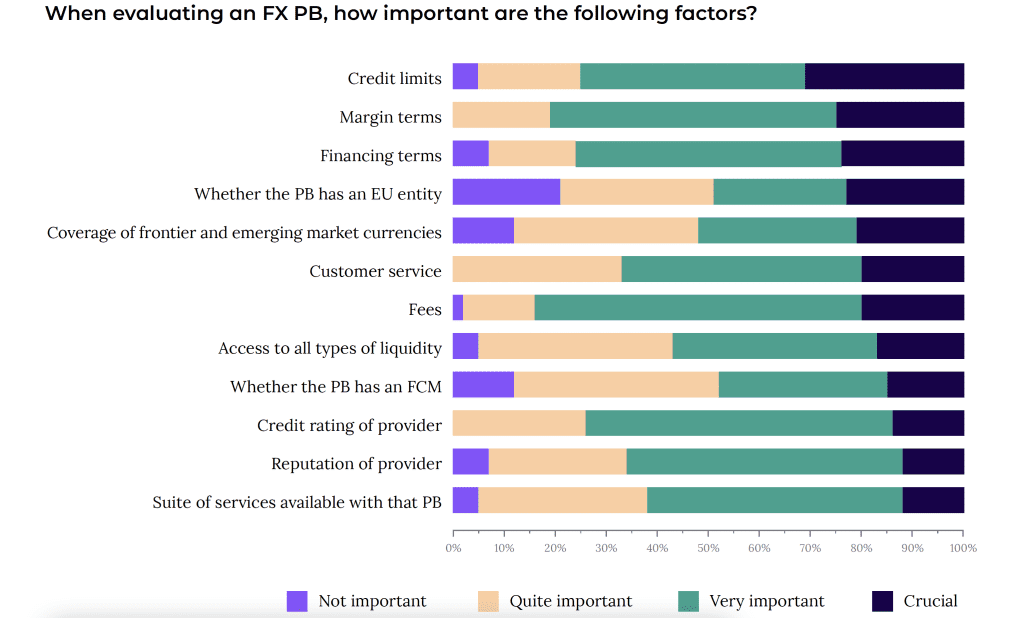

Given this general unfamiliarity with the non-bank FXPB world, how would he recommend firms evaluate potential partners? “Low latency price formation in OTC products is very much a base requirement,” Alexander says. “With more processing of quotes and orders comes more load and a highly resilient/redundant set-up has never been more critical.”

“The level of effort and investment that is applied to ensuring maximum resiliency continues to rise. As an example, for the ingestion of market data, 26 Degrees deploys multiple data vendors, each cross-connected in multiple locations providing hot-hot backup capacity to all clients across our server network in NY4, LD4, and TY3,” explains Alexander.

“In turn, each of these pricing/trading servers is backed-up hot-hot with real-time replication from full spec servers in a separate data centre.”

How will FXPB evolve?

Given the volume of changes FXPB has experienced over the past few years, market participants can expect even more changes and Tier 1 consolidation to occur. From an APAC perspective, Alexander believes the reduction in US settlement cycles is a positive step forward.

“More broadly, this reduction in settlement risk should see pressure on margin requirements ease. As a non-bank PB, we can offer our clients synthetic, non-deliverable spot FX where positions are auto-rolled daily, meaning our clients can hold spot FX and Metals positions indefinitely with daily Credits or Debits posted in lieu of swap rates,” he says.

Insights

Latest insights from

26 Degrees